Koau capital partners

Understanding Māori investment.

The Māori economy contains an abundance of vision and opportunity.

Koau Capital Partners Ltd is a new partnership experienced in sourcing, structuring and managing assets within the Māori commercial sector.

>A new partnership

Koau’s partners have a background of successfully working together within the Māori economy and cultural landscape.

Our Team

|

Andrew Harrison. |

Alexander McKinnon. |

Richard Coleman. |

Mark Tume. |

Brad Tatere. |

Bevan Hames. |

Jim Jessep. |

Jordan Pentecost. |

Rogier Eradus. |

|---|

Andrew has an investment background and worked extensively within iwi organisations.

Andrew worked for the Ngāi Tahu Group for six years. Most recently he was Chief Operating Officer of Ngāi Tahu Holdings Corporation (NTHC), a diversified investment company with assets over $600m across the property, tourism, rural, healthcare and seafood industries.

Andrew’s earlier background includes work in Asia, Mexico and London for Halliburton, culminating in the role of Global Proposals Manager. He began his career as a chartered accountant with PriceWaterhouse Coopers.

Andrew has experience and skills in capital allocation, mergers and acquisitions, capital structuring and asset performance management.

Alex has worked in corporate finance and investment in China and within Māori business.

Alex started his finance career in China, undertaking strategic and transactional advisory work for a range of foreign companies across the agriculture and food products, technology, energy, manufacturing and services sectors.

Prior to Koau, Alex worked as an investment analyst at Ngāi Tahu Holdings Corporation.

Alex brings knowledge of a major New Zealand primary products market and strategic and analytical ability. Alex has an MA from Cambridge University and additionally studied at the University of Provence and Mandarin at Qinghua University, Beijing.

Richard has spent most of his professional career in executive roles within Māori owned operational and investment sectors.

Richard has a finance and accounting background and worked for Ngāi Tahu Seafood for nearly a decade before taking up the role of Group Investment Manager at Ngāi Tahu Holdings Corporation in 2005, gaining responsibility for oversight of the performance of all Ngāi Tahu commercial investments as well as analysis of new business opportunities.

He returned to Ngāi Tahu Seafood as chief executive in 2008 and led a range of business improvement initiatives. In extremely tough economic conditions, NTS posted a record operating EBIT in FY09 followed up by a record half year result for FY10, prior to Richard leaving and joining Koau.

Richard is well respected within Māori business for his strategic as well as analytical strengths and attention to detail. He brings thorough knowledge and extensive relationships across the seafood industry and its markets to Koau. Richard's experience enables him to apply robust governance and investment disciplines in complicated stakeholder environments.

Mark is a professional director with significant experience in the infrastructure sector.

Mark holds a number of directorships with listed and unlisted companies in New Zealand and Australia, including the New Zealand Superannuation Fund, Infratil, New Zealand Oil and Gas board and New Zealand Refining Company. He was previously on the board of Transpower.

Mark also has experience in the Māori commercial arena including previous appointments as managing director of Lake Taupo Capital, and director of Ngai Tahu Holdings Corporation.

Mark has had a 20-year career working in the New Zealand banking and funds management industries, and is a former president of the NZ Financial Markets Association. He was previously Head of Funds Management at the Bank of New Zealand and has held a number of senior roles within the finance industry specialising in investment, asset and liability management, capital markets and risk.

Brad has extensive experience across the primary sector through his pervious roles in agri-corporate banking, investments and governance.

He understands the cyclical nature of businesses, and how the volatility of commodity and financial markets can impact production and export businesses. He has assisted primary sector companies to understand and deal with risk, develop their strategic objectives and their approach to portfolio construction to deliver real returns to shareholders.

Brad plays an active role in the management and governance of Māori owned assets and focuses on improving commercial opportunities, as well as providing pathways to develop capability to ensure the legacy of “taonga assets” continue. It’s important to Brad that Māori have strong representation in businesses and on boards that are focused on improving the performance and productivity of collective Māori resources and assets.

Brad has a bachelor’s degree in science and is completing a Master of Agri-commerce from Massey University. He is also member of the New Zealand Institute of Directors and is a past participant of the Kellogg Rural Leadership Programme.

Bevan has strong property acquisition, development, construction and lease management experience throughout New Zealand and Australia. With nearly 20 years' experience in the Property and Construction sector, Bevan has held Senior Executive positions with ESR Property Ltd, Wesfarmers Retail Property Group, Apollo Projects Ltd, and various private development companies.

Bevan's roles have varied from Planning Consultant, Development Manager, Investment Manager, National Business Leader, and executive Director. Bevan has also owned and operated several private development companies.

Bevan leads the property activity of Koau and Hāpai Property, including the Hāpai Commercial, Hāpai Housing and Hāpai Development funds (pan-Iwi institutional property funds). Along with managing these property investment vehicles, Bevan also manages development projects on behalf of individual and/or collective commercial entities.

Bevan sits on several property boards and is qualified under the Real Estate Agent Act 2008.

Jim is a qualified chartered accountant who had a career with PwC followed by senior corporate roles in the UK and New Zealand, notably with Vector.

Jim then established a property investment and development operation in Brazil. Jim brings strong financial skills, experience in property and tax as well as broad strategic and commercial experience to the team.

Jordan is a qualified chartered accountant who had 4 years’ experience with EY New Zealand, and then worked for two years with Coller Capital and Tate & Lyle in the UK. Experience included transaction advisory (business valuations, acquisitions and divestments), financial modelling, private equity and corporate in-house mergers and acquisitions.

Rogier has extensive experience in strategic and operational planning and delivering large transformation programmes to drive operational efficiencies. Rogier has worked across multiple industries including primary sector, investment banking, insurance and telecommunications for some of the largest global brands.

Having returned from the UK in 2008 Rogier worked with Ngāi Tahu Holdings Corporation in helping to establish the systems and processes to support their large scale dairy conversions, and was also involved in supporting their other subsidiaries (tourism, seafood and property) in delivering on strategic goals and objectives. Rogier has very strong programme management experience across complex, large scale programmes. Most recently he successfully delivered a $90m programme for Farmlands across their finance and supply chain operations.

Rogier qualified from the University of Canterbury with a Bachelors Degree in Commerce and Law, and brings with him strong delivery and planning experience, with strong analytical capability.

Targeted, specialised services

The Māori economy presents financial challenges for investment and management that are unlike any other. Our services are tailor-made for this unique environment.

Our Services

Koau Capital Partners focuses effective investment, governance and management in a Maori commercial environment.

Investment management

Providing on-contract investment management services to Māori institutions including investment strategy, corporate capacity development and governance advisory and support.

Collective solutions and transactional advisory

Developing solutions and strategies for Māori institutions or groupings in areas of common commercial focus such as statutory right management (e.g. deferred settlement and right of first refusal), infrastructure, primary sector development and private equity.

Sourcing capital

Combining capital and disciplines from aligned, long-term, third party investors with Māori economic opportunities through co-investment

Governance and management advisory

Delivering commercially focused strategic advisory services to government or Māori sector bodies where Koau Capital Partners can encourage the development of global governance and capital management solutions

Investment strategy

Advising on asset portfolio management and capital allocation across those sectors where Māori institutions have direct and active investments

Early Māori innovators and investors

Māori were historically entrepreneurial and rapidly adapted their skill and instincts to the developing market economy.

Māori Innovation

Deliberate, large scale trading between Māori communities and European vessels was common place at all New Zealand ports from the early 19th century.

It was not long before Māori owned their own ships and several thousand acres were planted in western crops such as potato and wheat. But once the colony’s major cities became established the rate of change increased and the quantity of land available to Māori declined. By this time though many Māori were already familiar with the notion of capital investment and had the vision to see growth potential.

On 6 January 1860, Canterbury Māori leaders met with then colonial governor, Gore Browne, at Port Lyttleton to discuss their vision for developing the local economy. They were concerned that they did not have a market place or critical infrastructure and used the metaphor of a koau to explain their position:

“We are like unto a koau sitting on a rock. The tide rises, it flows over the rock, and the bird is compelled to fly. We require a dry resting place for us that we may prosper.”

They respectfully appealed to the Governor for assistance to erect a flour mill at Port Levy. Having already spent nearly £400 to purchase all the necessary machinery, they did not have the expertise or the capital to build the mill and requested a specialist millwright to manage the work and capital to complete it, which they would repay once the income from the mill was sufficient.

The mill was a great success and to this day Māori have strong relationships with central and local government, a deep commitment to New Zealand’s future economic strength and opportunities for access to many of New Zealand’s key assets classes.

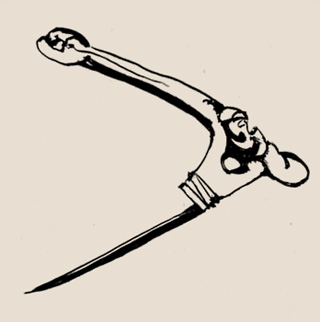

The symbol that guides us.

The Koau is a native bird admired for its dedicated flight towards its goal.

The Koau

The Koau was often likened to both successful warriors and resilient travellers and explorers. It was admired for the strength of its unswerving flight

"We are like unto a koau sitting on a rock."

Like early Canterbury Māori searching for productivity enhancing investment, our economic aspirations are captured by the aquatic bird, the Koau (pronounced kor-oh) - admired in Māori lore for its strength, determination and unswerving flight.

For us the Koau represents strong vision, determination to succeed and an absolute focus on our purpose – which is to provide unique investment and asset management solutions that create value in a dynamic, progressive Māori economy.

Contact

Koau welcome any questions or enquiries. Please contact any member of the team on email handle christian name at koau.co.nz

Head Office

Unit 4 / 71 Gloucester Street

Christchurch 8013

Wellington

L1, The Old Steamship Building

57 Customhouse Quay

Wellington